BBTP is currently looking to employ traders who have demonstrated successful algorithmic-based trading. If interested, contact us with a CV as well as trading history. Note: Trader applicants must demonstrate trading success with their algos but do not have to possess an automated program.

You Think You Know

In the past, you may have had a hunch (or you read some news or had insider information) that a stock or ETF will be trending up or down, so you executed your trade based on this assessment (with a live broker, financial advisor, or as part of a mutual fund) and scored big profits (or losses). Or, instead of using fundamental information, maybe your ability to quantitatively read a stock chart is par excellence, and you inputted your stock orders into trading platform (like TD Ameritrade, ETRADE, or Interactive Brokers) by pushing a mouse button to make market or limit order trades. I predict, if you are still a trader, you have been successful enough to stay in the game. I also predict that many of you may have incurred losses, even significant losses. Trading is inherently risky– one poorly placed trade and you can lose a quarter to even half of your investment. If you are successful all the time, would you be reading the information on this website?

Data Analysis vs. Decision Making

Trading involves two primary brain functions: data analysis and decision making. While some of us are very good at data analysis, no one, in their right mind, would ever claim to be as good and fast as doing data analysis or calculations as well as a computer. Regarding decision making, many traders make poor, often emotional decisions on the fly, because of poor, or inadequate analysis.

Here are more reasons why traders lose money.

More effective data analysis and ultimately decision-making can be done with a computerized algorithm on when to enter and exit a trade. A very clear example of the benefits of computerized algorithmic trading is to compare how we learned math in grade school with how we do math now. Many years ago, all of us (all who were raised in societies where school is mandatory), did math in our heads, or on paper (like long division) which took several minutes or longer to accomplish. It was hard work with lots of technical details to consider as the numbers got bigger and bigger. What happened as these numbers got bigger? If you grew up in the 1980-90s, our teachers started letting us use calculators. Calculators allowed us to focus our brains on higher functions rather than simply analyzing numbers. And, they saved us a lot of time.

Simple Math

Think about “simple” high school math (with algebra, trigonometry, and maybe calculus) equations and compare it to all the math that makes up a stock trading chart. Without the assistance of a computer analyzing dynamic trading mathematical input, many traders just attempt to do math, super complex math, with limited success in their ability to make predictions. Along with several other factors, poor mathematical analysis and decision-making are responsible for the fact that 90% of all intraday traders, that is, 1.5 million traders each year in the U.S., lose money.[1]

So, given these odds, how can we win at the game of day trading (or investing) at all? For many people, the time spent investing in researching stocks or the risk of seeing a daily loss is simply not worth it. For these investors, the smartest thing to do is buy index funds (ETFs or ETNs based on large diversified groupings of stocks). Tony Robbins has a great book called Unshakeable about the benefits buying these types of index funds (as a superior way to invest over trading individual stocks or giving your money to a financial advisor). If you don’t want the risk of day trading and want to hang on to the inherent, diversified value of the market at large, look into index funds. (Of note: For ethical reasons, I do not personally buy ETFs or ETNs that track the S&P (like SPY) or Nasdaq (like QQQ) but I will buy funds that short sell them[2]. In the current market, I like ETFs such as SPXU, DOG, CHAD, or Treasury Note Futures; I also like to trade volatility indexes such as the VXX or TVIX).

Robbins makes another great point in his book. That is, if you think that a financial advisor or your 401K provider is better at making stock trades or protecting and growing your assets, or even has your best interest in mind, think again! Of the 310,000 financial “advisors” in the U.S., 90% of these advisors are just “brokers,” which means that they have no fiduciary duty to uphold best interest of their clients.[3] Robbins properly denotes the so-called advisors as “brokers” because a broker is “paid to sell financial products [regardless of true value] to customers like you and me in return for a fee.”[4] To clarify this point more, Robbin’s writes, “Brokers don’t have to recommend the best product for you.” He quotes David Swensen, Yale University’s investment guru, saying, “‘No matter how much you like your broker; ‘Your broker is not your friend.’”[5]

In lieu of the above information, if you decide that you care about your assets more than the brokers who just want to sell you their financial products for a fee, maybe day trading for with a small portion of your assets is for you. I will warn anyone interested in trading, whether it’s day trading or long-term investing, there is incredible risk. (Also Note: To be legitimized as a Pattern Day Trader, you must hold a trading account balance of at least $25K. If you make day trades without this account balance, you will be locked out of making any entry trades for 90 days or more or until your account balance is $25K or more).

Psychology of Trading

Ultimately, day trading is about predicting the future. Given the complex dynamics of the market, making predictions about the future is no easy task. If you read the Undoing Project by Michael Lewis, you will find that, according to Nobel Prize winning psychologist Daniel Kahneman and his colleague Amos Tversky, we all have certain, often subconscious biases that sway us from accurate analysis and predictions about future events, including market moves. In the book, Lewis clearly explains Kahneman and Tversky’s work on understanding these multiple types biases as well as advocating computer assisted analysis over human analysis, not only for financial trading as well as for other areas–such as medicine. Understanding the psychology of how traders analyze and make financial decisions is a growing field called “behavioral finance.” The following quote sums up the difficulty behind “predicting the future” in finance by amateur as well as professional investors.

‘Behavioral Finance’ reflects that investment markets provide data sets for analyzing judgment under uncertainty. Millions of amateur investors continue to actively buy and sell securities regularly, despite overwhelming evidence that even professional investors are no more likely to beat the market than monkeys throwing darts at securities listings. Most people do not realize how little they know about the subjects or how difficult it is to bracket estimates.

People come up with what they believe to be logical estimates, then they adjust from those figures, but unless you work in the field, your initial estimates are probably going to be wildly off the mark. One study collected more than 25,000 forecasts from people whose job it was to anticipate how the future would unfold. All demonstrated remarkable overconfidence. Few entrepreneurs would start new businesses unless they believed that they would succeed in the face of long odds.[6]

In lieu of the above quote, perhaps we think we have an edge over the masses of investors and traders in the financial world.

If so, it is worth exploring what kinds of biases we might be bringing to our financial forecasting table.

A great math example (from Kahneman and Tyversky) is how we use a behavioral method (aka heuristic) called “anchoring and adjustment” to make quick decisions.

A group of 5 high school students were given 5 seconds to accurately multiple the following numbers:

8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = ?

Another group of 5 high school students were given 5 seconds to accurately multiple the following numbers:

1 x 2 x 3 x 4 x 5 x 6 x 7 x 8 = ?

The median answer for the first group of students = 2250

The median answer for the second group of students = 512

The actual, calculated answer for both sets of numbers = 40,320. The real issue is not only how inaccurate the both groups of students were from the accurate, calculated answer, but how far the first group of students in estimating the answer (median = 2250) was from the second group of students (median = 512). The first group had used “8” as a starting point so their minds “anchored” with this larger initial value and thus “adjusted” there estimates much higher.[7]

How many of us made this behavioral fallacy with stock trades? If we see a stock bouncing higher initially, we think our profits will be greater and so we rush to get into the stock, often at too high of a price. However, if we look back at the stock’s actual, average daily movement, it might be just a fraction of what we think it will move. Without the help of a computer, our estimates and decisions (usually made emotionally within seconds) are, at best, grossly overestimated–because the bias we give to the initial anchored value we hold in our minds.

For market movements, one may consider this general perspective of short- and long-term predictability of a particular stock or set of stocks, even with a computer’s help.

Predictability

With a few trending popular stocks, everything somewhat predictable happens within 5000 milliseconds or less. The further away from the present moment, the less accurate the prediction becomes. After 5000 ms, more and more uncertainty sets into the price of a stock or ETF.

All In

New buyers and new sellers, new volumes, new fundamentals, new decisions, random price spikes, dark pool deals, etc all make a successful prediction in price of a particular stock (or fund, exchange, ETF, etc) change impossible to determine.

Unpredicatable

Unless a trader has the power of a market maker (or powerful fiber optics as with high frequency traders) to move (or distort) its price to the next buyer or seller, the price movement of any stock is never predictable for more than about 5 seconds after the present time.

Unlimited Possibilities

No one can amass all of the data occurring every second about what’s behind stock values at any given present or future moment. Quantitative traders look at the past trends and stock movements to find follow future trends while many other traders, use their hunches, fundamental data, and the advice of so-called experts to make big and small stock decisions.[8]

WHY ALL THIS MATTERS

Given the above information, predicting market movements, especially long term, can seem impossible. However, with the help of computer analysis, it may be possible to be accurate about a stock’s trajectory for 5000 milliseconds (5 seconds) or more. A few critical points sum up BlackBox Trading Pros theories on the science of analyzing and making trading decisions:

1.

Many individual day traders are flying literally “by the seat of their pants” or simply falling to the ground because they are inadequately equipped predicting the future because of jaded, unfounded, or old market information. Hence, the success of many traders is largely luck.

2.

The longer a trade of a particular stock is held, the less reliable the information used to make a prediction about that trade becomes.

3.

Using computerized algorithmic trading programs is a superior and more effective way to trade financial securities than by human analysis and decision making alone. Co-founder of Sun Microsystems, Vinod Khosla writes, “In finance as well as medicine, algos reign supreme.”[9]

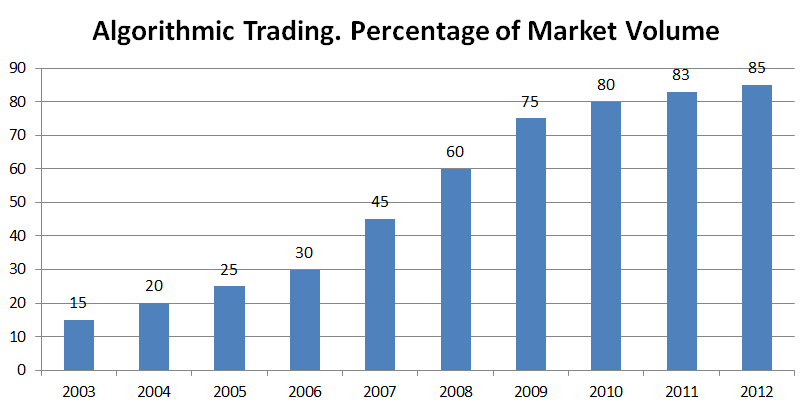

Finally, if you think algorithmic trading is something for a few futuristic computer geeks ahead of their time, you are less informed. As of 2012, over 85% of all trading, as a percentage of market volume, was determined algorithmic trading. See bar graph below.[10] In June 2017, JP Morgan confirmed that an estimated 90% of trading is algorithmically driven.[11]

While most all trades, by volume, are algorithmically governed, this large trading volume is all due to trades made by large institutions, banks, or hedge funds. Many retail and small traders and investors, unless they belong to an institution or fund, are not receiving the advantage of algorithmic trading at all.

OUR MISSION

The mission of BlackBox Trading Pros (BBTP) is to provide the best possible algorithmic advantage to the retail trader possible to help these traders make more effective, more accurate, and more profitable trades. The Low Frequency Trader Buy Program we are releasing is only one of many computerized algorithmic programs we plan to release publicly. Also, if you have an algorithm you would like tested, custom built, or you want to modify the LFT programs, we are open to crowd sourcing with qualified programmers or traders. There is no reason retail traders should not have every algorithmic advantage available to larger institutions.

Trading, like many adventurous extreme sports, is risky. very risky. Is the adventure of trading really worth it? I’ll finish with a few thoughts by Steve Casimiro, editor from Adventure Journal:

“A life filled with adventure tastes sweeter than one viewed from the couch. And as science tells us, sitting on the couch isn’t exactly the safest place to be, either…..The big difference between the me [in the past] and the me today is that I’ve learned that risk can be managed. Not all of it, or it wouldn’t be an adventure.”

Perhaps trading is a risk worth taking. If so, algorithmic trading may be the best way to manage that risk but trading will still be an adventure. Enjoy the adventure to the fullest!

Dr. John Hughes, D.O.

CEO

BlackBox Trading Pros, LLC

Further References

https://www.investopedia.com/articles/investing/091615/world-high-frequency-algorithmic-trading.asp

[1] https://www.eqsis.com/why-intraday-traders-lose-money-in-the-stock-market/. Also see https://www.quora.com/How-many-traders-are-there-in-the-world-broken-down-by-country

And there are loads of traders and investors out there in the market. “According to “The Modern Trader” report, released by Broker Notes, there are 9.6 million traders worldwide. Basically, 1 out of 781 people on the planet trade online.” What percentage of these gamblers actually make money? According to the data, only about 10% of all day traders make money. From https://www.eqsis.com/why-intraday-traders-lose-money-in-the-stock-market/

[2] SPY is a ETF that tracks the S&P, which contains companies that I do not voluntarily support such as Exxon. Nasdaq is tracked by the QQQ, which has 100 tech companies but also companies like Pepsico which I, as a physician, do not support. Note: To “short sell”, or “short”, is to borrow shares of these funds at higher price and then buy them back at a lower price so that you make money as the stock or ETF loses value.

[3] Robbin, Tony. Unshakeble, p. 71, 75 Robbins writes that “over 40% of Americans use financial advisors.”

[4] Ibid., p.75 Bracketed verbage added.

[5] Ibid, p. 78, 80

[6] This is a quote from a private medical practice valuation which cannot be referenced to the public.

[7] Lewis, Michael. The Undoing Project, p 192-193.

[8] Hughes, John. 5000ms–a book in the making about predicting the future

[9] This is a quote from a private medical practice valuation that I considered purchasing in 2018.

“A world mostly without doctors (at least average ones) is not only reasonable, but also more likely than not,” wrote Vinod Khosla, a venture capitalist and co-founder of Sun Microsystems, in a TechCrunch article titled “Do We Need Doctors or Algorithms?” He even put a number on his prediction: someday, he said, computers and robots would replace 80% of physicians in the United States

[10] “Algorithmic Trading. Percentage of Market Volume.” data from Morton Glantz, Robert Kissell. Multi-Asset Risk Modeling: Techniques for a Global Economy in an Electronic and Algorithmic Trading Era. Academic Press, Dec 3, 2013, p. 258. See https://en.wikipedia.org/wiki/Algorithmic_trading#/media/File:Algorithmic_Trading._Percentage_of_Market_Volume.png.

[11] https://www.cnbc.com/2017/06/13/death-of-the-human-investor-just-10-percent-of-trading-is-regular-stock-picking-jpmorgan-estimates.html

Interested in trading with a computerized algorithmic program?